The Rising Influence of ESG in Credit Ratings: Everything You Need to Know Sustainability and ethical practices have become an essential element of a company’s growth in the long term. The evaluation in today’s landscape is not just based on the financial profile of the company but also on the management of ESG risks. ESG – Environmental, Social, and Governance Ratings play an important role in assessing a company’s sustainable and environmental initiatives along with its social practices. With ICRA ESG ratings, companies elevate their reputation and attract potential investment that aligns with their sustainability practices. Investors and stakeholders have a clear picture of a company’s overall performance, along with its sustainability and ethical outcomes. ESG ratings also drive investors towards sustainability by managing potential risks associated with it through well-defined decision-making processes. This impact of ESG ratings is not just on the environment but also encourages companies to strive for sustainability and adopt ethical practices further fostering responsible investment. How ESG ratings are evaluated A comprehensive evaluation of a company’s profile and performance is done across all three aspects to give it an ESG rating. A specific metric is used to assess environmental sustainability, social responsibility, and governance practices. Let us take a look at how these criteria are taken into account- Environmental Evaluation – This is a reflection of impact on the environment by the company along with a demonstration of their efforts to operate sustainably. The evaluation is done across various areas with a key focus on carbon emissions and climate change mitigation, energy efficiency, resource management, and environmental compliance. The data is further used from various sources to give a score to each of the factors thereby reflecting the commitment of the company towards sustainability and responsible environmental practices. Social Evaluation – With a focus on a company’s relationship management with its employees, customers, and the broader community. This evaluation is done to promote better ethical practices and foster positive societal impact. The assessment is done on labor practices and employee well-being, human rights, customer relations, and community engagement. This is required to ensure that safe working conditions along with fair labor practices are implemented for the well-being of the employees along with the prevention of unethical practices such as child labor and exploitation. Governance Evaluation – A key aspect of governance evaluation is that it examines a company’s leadership along with its decision-making process while making sure of its adherence to ethical standards. It reflects a company’s balanced independent board, its respect for accordance with shareholder rights, and its transparency and accountability while managing its operations. Governance evaluation is held to give a clear picture of ethical principles that are supported by the company. ESG Ratings by ICRA ICRA ESG Ratings provide a benchmark for evaluating value and sustainability in the long term by providing an in-depth analysis of a company’s ESG aspects. In a world where financial metrics are given more importance, the role of ESG ratings can’t be overlooked as they promote responsible business practices. For more info Visit here: www.icrallc.com

Category: ICRA Scorecard

ICRA Scorecard Unveiled: Your Comprehensive Tool for Business Assessment

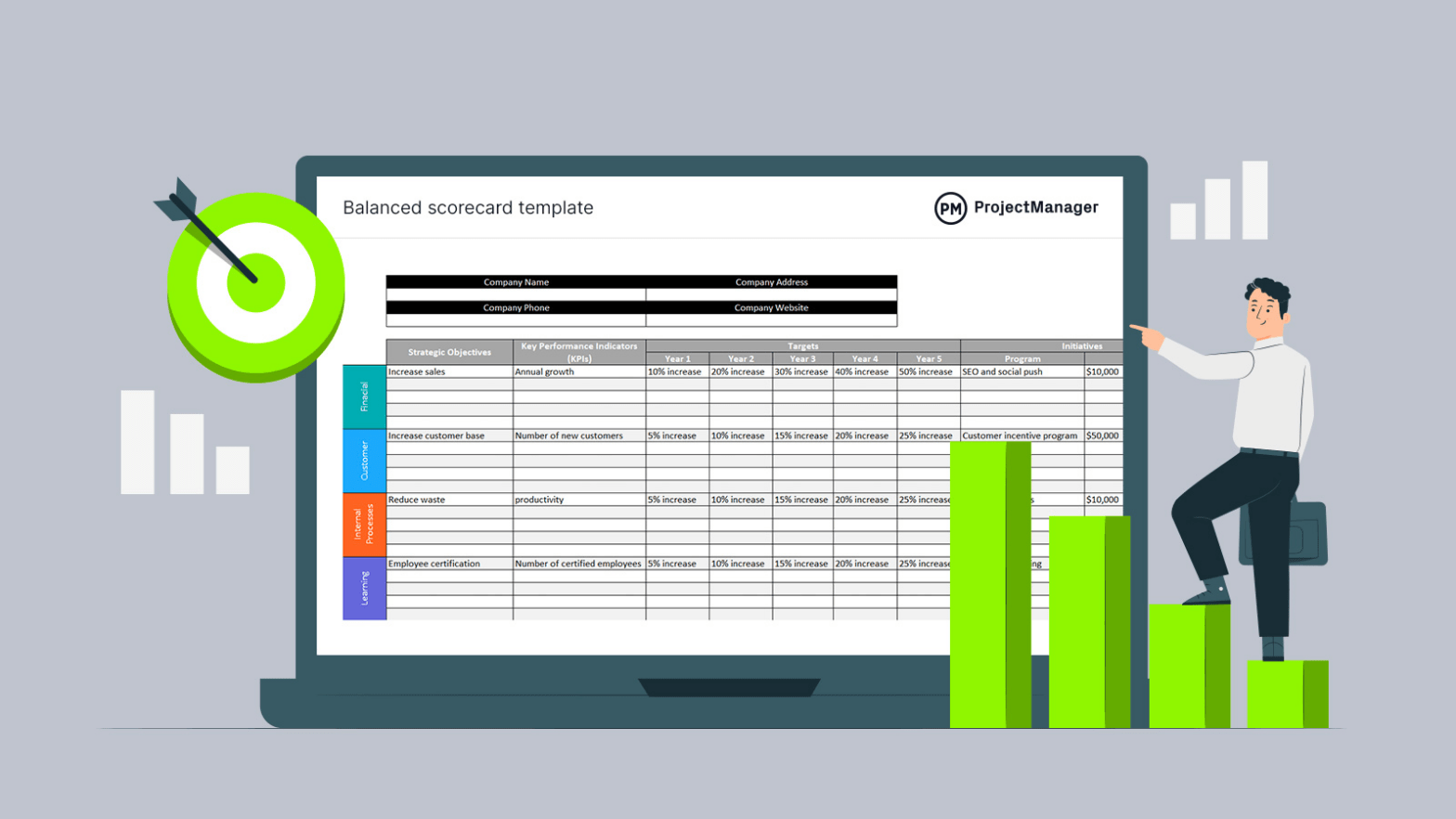

ICRA Scorecard Unveiled: Your Comprehensive Tool for Business Assessment ICRA Scorecard is an indispensable tool that is free of charge and lets investors leverage its benefits by evaluating their financial performance. A prime benefit of the scorecard provided by ICRA is that complex information is distilled into a structured and understandable format. Investors and stakeholders can make well-defined financial decisions by understanding the credit risk associated with an entity through a comprehensive report presented by the ICRA Scorecard. In today’s dynamics, understanding and managing credit risk has become crucial to fostering growth and maintaining financial stability. By leveraging the benefits of the ICRA Scorecard, one can evaluate their business creditworthiness and elevate their financial standing in the industry. The ICRA scorecard delivers a standardized framework for evaluating and assigning credit ratings, which is based on several factors such as financial performance, industry dynamics, and macroeconomic trends. Benefits of ICRA Scorecard An enormous influence of the ICRA Scorecard can be seen on the financial market as investors and stakeholders rely heavily on these financial insights. Since the ICRA Scorecard provides a transparent and accurate creditworthiness of the entities it lets investors get a clear understanding of the entity’s overall performance. Insights such as cash flow, debt levels, and revenue are helpful since they guide investors into making well-defined investment decisions by assessing the overall financial profile of the entity. Loans are easy to secure with the demonstration of creditworthiness since investors are most likely to engage with investors that offer transparent credit assessments. The overall performance of the businesses can be elevated with the insights provided by the ICRA scorecard as it lets them improve their areas of strengths and weaknesses. This enables them to attract potential investments and also differentiate themselves from the competitors in the industry. The use of robust methodology and metrics helps in ensuring that a standard level of rating is done further opening new doors for better opportunities. ICRA Scorecard lets you be in the eye of the investors with the showcase of credibility that helps you gain better access to funding at reasonable rates further elevating your reputation in the market through a strong credit rating. With a higher rating, negotiation is done better as it is a significance of reliability and credibility with an unlikely run for any risk of default or non-payment. ICRA Scorecard: Your Performance Benchmark ICRA scorecard empowers your business with elevated growth and embraces your full potential by enhancing your financial stability. The navigation in the financial arena becomes easy with the stimulation of informed decision making thereby seizing new opportunities with utmost confidence. A clear picture of your position in the market is offered by the ICRA scorecard that lets you access invaluable insight further helping you plan your strategic moves for a better performance against the competitors within the industry. For more info Visit here: www.icrallc.com

ICRA’s Bank Ratings: Benchmark for Trust and Credibility

ICRA’s Bank Ratings: Benchmark for Trust and Credibility Bank ratings by ICRA assess the creditworthiness of the banks. Bank ratings hold significant importance in the financial arena since stakeholders rely on them to comprehend the stability and reliability of banks. ICRA plays an important role in providing in-depth assessment of entities to gain access to their financial health and overall profile. Bank ratings by ICRA help provide insights regarding the overall performance of the bank such as their asset quality, profitability, and management quality. The bank rating range is a reflection of a bank’s ability to meet its financial commitments and the potential risks involved. These ratings range from high-grade to speculative grade, further labeling various levels of risks in accordance with each grade as a high grade indicates the very low level of credit risk involved, and similarly, a speculative-grade is an indication of higher credit risk. Why do bank ratings matter? These unbiased evaluations hold paramount importance when it comes to stakeholders such as investors, regulators, or customers to make an informed decision. Let’s take a look at the importance of bank ratings and why they matter not just for stakeholders but for banks too. Boosts Confidence and Decision-making: To make well-defined decisions regarding investments bank ratings are crucial since investors rely heavily on it. These ratings help investors in maximizing their returns by diversifying their investment portfolio. A bank that has a high rating makes them an attractive investment choice since they indicate low risk thereby enhancing a bank’s reputation and its stock price. Economic Impact and Market Stability: Banks have a major impact on the economy and with these ratings, it becomes easy to identify banks whose failure could have a significant impact on the financial landscape. A smooth functioning of the financial market is also crucial in the broader economic system which is done when the public places their trust in a strongly rated entity or banking system. Access to Capital and Borrowing Cost: The terms of credit lines and their availability are largely influenced by ratings which can further affect a bank’s liquidity and other operational management. It will be easier to gain access to the capital market at a low cost if the bank is rated high and this is done by negotiating for better loan terms thereby reducing the overall cost of capital. Invest Smart, Invest Safe – With ICRA Bank ratings are not just mere numbers but rather they hold paramount importance because of their benefits in the economic sphere. These ratings are beyond assessment since they have a far-reaching impact on investors, regulators, customers, and the bank themselves. When the public is provided with a transparent picture of an entity’s creditworthiness, it becomes easy for them to make decisions and place their trust in the stability of the financial system with these ratings. Ensure financial stability and unlock financial clarity with ICRA’s trusted bank ratings. With the evolving challenges in the financial sphere, ICRA stands up to its mission with a commitment to provide accurate and transparent ratings. With ICRA’s robust methodology and in-depth insights, stakeholders get to make clear-cut decisions with access to reliable and credible assessments further facilitating economic growth. For more info Visit here: www.icrallc.com

Credit Ratings: Its Impact On Financial Stability and Investment Decisions

Credit Ratings: Its Impact On Financial Stability and Investment Decisions Credit ratings hold a front foot when it comes to the financial sector since they determine the borrower’s financial statements on a broader term. Credit ratings reflect a borrower’s creditworthiness and their likelihood of meeting financial obligations in a given time frame. Credit ratings can have an impact on the overall performance of the financial market since they affect borrowing costs and further influence the market stability. Credit ratings not just impact the overall financial market but also assists investors and lenders in making well-defined decisions by providing them with an assessment of risk associated with a certain investment. At ICRA Credit Rating Agency, we help provide the credible and transparent in-depth evaluation. Credit ratings are determined by various factors such as the financial statements of the borrower’s which includes their income, debt levels, further their economic conditions and borrower’s position within the industry is also taken into consideration when evaluating a credit rating. Showcase your credibility with a higher credit rating and open doors for multiple opportunities by gaining investors confidence and trust. Crucial Role of Credit Ratings in Financial Markets Credit ratings are vital in the financial landscape since investors rely heavily on these ratings while making any investment decision. Not only investors but Governments and public sectors to gauge their ability to borrow money to fund projects and developments and manage public debt. With a higher credit rating, one can have better access to new markets and expand their business by taking it global. A strong credit rating not only attracts investors but it also helps you grow with new opportunities in the market and unbolt confidence with a standard position in the industry. Since credit ratings provide in-depth insights regarding an organization and its performance, further providing an understanding of the strengths and weaknesses of that organization. These insights help an organization to gain a picture of their position in the financial market and improve their areas of weakness inorder to compete against industry peers. A demonstration of transparent credit rating offers a comprehensive picture of the financial performance of an organization and with this it allows investors to make informed decisions regarding their investments. This helps in building trust and security with potential investors by articulating your financial health and risk profile with the transparent presentation of the creditworthiness of your organization. Why Choosing ICRA Credit Ratings is a Smart Move? ICRA is a trusted credit rating agency that has served in many countries across the world by providing accurate and transparent credit ratings for various financial institutions. Navigate the complexities of the financial landscape with utmost trust and confidence with ICRA Credit Ratings. Gain investors confidence and elevate your business growth to new heights by showcasing your company’s creditworthiness. With ICRA Credit Ratings, achieve a competitive advantage in the global financial sector by taking well-defined investment decisions. Gain a positive reputation by maintaining good relations with the investors in the market and improve your overall market perception for future funding. Let ICRA experts with years of experience help you gain an in-depth analysis of your financial profile with their use of rigorous methodology to further help you achieve success and growth. For more info Visit here: www.icrallc.com

Navigating Financial Success with ICRA Scorecard

Navigating Financial Success with ICRA Scorecard At ICRA, we provide a holistic view of an entity’s credit profile by taking into consideration alot of factors with the ICRA Scorecard. ICRA Scorecard is not just an evaluation tool that provides a comprehensive report by assessing credit worthiness of an entity but it also provides an understanding of credit risk associated to help investors make well-defined financial decisions. ICRA Scorecard is a free of cost tool which enables investors to leverage its benefits with evaluation of their financial performance. Various factors such as management quality, market position and industry dynamics are taken into consideration while assessing a company’s credit standard. With ICRA Scorecard boost your confidence and be in the eyes of the investors with demonstration of transparent credit assessments. So whether you are a financial institution in Uganda, Tanzania or UAE let ICRA Scorecard be your ultimate ally in supercharging your credit evaluations. Securing loans or credit has been easier only if you choose to avail your ICRA Scorecard today. Leverage ICRA Scorecard benefits – ICRA Scorecard has a huge influence on the financial market since investors and lenders rely on accurate and reliable credit assessments. ICRA Scorecard offers a holistic view of the creditworthiness of the entity with a detailed insight into the entity’s financial performance and risk profile. Insights such as cash flow, debt levels, and revenue are helpful since they guide investors into making well-defined investment decisions by assessing the overall financial profile of the entity. This clear demonstration of an entity’s financial profile assists in identifying, monitoring, and measuring any potential risks. The use of robust methodology with quantitative and qualitative metrics ensures a standard level of rating and allows easy comparison between entities in the industry. With a high score one can open the door for more investment opportunities get to be in the eye of the investors and gain access to better funding at lower rates. This enables an entity to showcase its credibility and a chance to uplift its reputation in the market with a strong rating. ICRA – Your Partner for Comprehensive Credit Insights ICRA Scorecard is a zero-cost comprehensive tool with thorough evaluation designed in a way to elevate your financial decisions. Investors and lenders get a better understanding with accurate assessments further fostering confidence in them while making any investment decisions. ICRA’s extensive global reach makes ICRA Scorecard an invaluable tool for cross-border financial insights. Get a holistic view and detailed analysis of your financial profile, company performance, and industry position that will assist you in comprehending your financial stability and areas to be improved for future growth and opportunities. With a clear picture of your position in the market, this insight will help you plan your strategic moves for a better performance against the competitors within the industry. With a commitment to providing reliable and accurate insights, ICRA’s global reach with over 110 ratings delivered across 25 countries in diverse industries serves as a testament to its vision. Let ICRA be your partner in navigating complexities with precision and making well-defined decisions to achieve strategic success and growth. For more info Visit here: www.icrallc.com

ICRA Scorecard – Understanding Its Role and Importance

ICRA Scorecard – Understanding Its Role and Importance Credit Rating Agencies play an important role when it comes to providing vital credit ratings that offer invaluable insights to investors and lenders. Amongst many services that ICRA Credit Rating Agency offers like ESG Ratings, Issuer Credit Ratings, and Portfolio Ratings, there stands a key tool – ICRA Scorecard. ICRA Scorecard is a Crucial tool that is used to evaluate the creditworthiness of various financial entities. ICRA Scorecard is designed in such a way that it provides us with transparent and objective information regarding credit risk which helps in facilitating well-defined decisions. ICRA Scorecard provides us with an in-depth understanding and assessment of financial health of an entity along with other parameters such as their position in the industry and their management quality. Why is the ICRA scorecard important? ICRA scorecard holds paramount importance and for many reasons. Here’s why.. Enhance Investor Confidence – It is a fact that many investors rely heavily on credit ratings when it comes to making investment. These credit ratings guide them by providing a transparent evaluation of creditworthiness and the potential risk involved. With these credit ratings it becomes easy for investors to navigate through the complexities of the financial realm and make informed decisions regarding their investment. Through ICRA Scorecard their confidence is boosted further facilitating more participation in the financial landscape. Promotion of Market Efficiency – ICRA Scorecard plays an important role when it comes to providing reliable and accurate credit assessments since financial markets depend heavily on availability of such information. ICRA Scorecard has an immense contribution when it comes to market efficiency and with this participants in the global market gets elite access to transparent and reliable credit ratings leading to a more stable financial market with better decision making. Effective Risk Management – Financial stability is crucial for investors with effective risk management. ICRA Scorecard helps mitigate risks by providing detailed information of credit risk involved further assisting investors in identifying, measuring and monitoring risks. This assessment ensures that engagement takes place with parties that are reliable further mitigating any risk of financial contagion. Access to Capital Markets – It becomes necessary for companies to gain funding to operate and for its growth. Investors favor entities that are rated highly which can further reduce the cost of capital for the issuer. This facilitates an entity’s ability to raise funds which can further be invested in expanding their projects and innovation. Leverage ICRA Scorecard for Financial Excellence Invest in the power of well-defined decision-making with ICRA Scorecard. At ICRA Credit Rating Agency we believe in providing credit evaluation that is comprehensive, transparent and accurate. With a motive to enhance investors’ confidence and fostering trust among counterparties, our key tool ICRA Scorecard holds a paramount importance in fostering this trust in the economic market and maintaining financial stability. ICRA Scorecard uses a robust methodology and with its continuous monitoring, it ensures that the information is provided with up-to-date information and accuracy. Reaching out to ICRA can be your next step toward financial growth and confidence. With ICRA you gain access to expert analysis, comprehensive rating services, and in-depth reports that can help you navigate the complexities of credit risk with great ease and confidence. For more info Visit here : www.icrallc.com

Comprehending ICRA Scorecard and its significance

Comprehending ICRA Scorecard and its significance ICRA stands out as a prominent player when it comes to offering invaluable insights via its scorecard. The very use of this tool is primarily to assess credit risk and guide investments, along with evaluating the worthiness of companies, banks, or financial instruments. The prime benefit of the ICRA Scorecard is its ability to distill complex financial information into an understandable and straightforward format. With the ICRA scorecard, the standardized framework for evaluating and assigning credit ratings is delivered accordingly, based on factors such as financial performance, industry dynamics, and macroeconomic trends. The securing of loans or credit becomes easy with the demonstration of creditworthiness. The use of scorecards simplifies the process, thereby reducing time and efforts, contributing to the management of human resources. With authentic credit ratings from well-designed scorecards, one can increase their confidence in the market, and through this, it increases a chance for the investors to engage with entities that have transparent credit assessments. A special benefit of the scorecard for the corporate customers comes with the major focus on strengths and weaknesses. This insight is further used for improvement in financial growth and other operational aspects. Navigation through the dynamic world of credit becomes unchallenging and confident for clients with their conscious decisions. The ICRA scorecard is your ultimate ally in supercharging your credit evaluations, whether you are a financial institution in UAE, Tanzania or Uganda. Used across borders, it assists in ensuring that financial institutions benefit from its thorough and reliable credit assessments. DECODING BENEFITS OF ICRA SCORECARD- Enhancing transparency – comprehensive criteria and scoring methodologies fabricate transparency in the credit evaluation process, enabling the clients to infer the understanding of the ratings. Efficiency – the use of scorecards oversimplifies the evaluation process, therefore saving precious time and valuable resources. The ICRA scorecard also helps in creating a well-informed marketplace in order to facilitate better decision-making amongst all the participants. Precautionary measures – the ultimate support in recognizing potential risks that come with lending or investing, further putting a halt to financial losses and enhancing portfolio stability with its dynamic risk management approach. Detailed analysis – with its thorough analysis, it ensures that every aspect of the financial statement is carefully analyzed and examined, thus providing an in-depth understanding of its creditworthiness. It makes sure that the clients receive a comprehensive assessment, further empowering them to take well-defined decisions. CONCLUSION – ICRA scorecard offers numerous advantages and benefits and also provides a path to navigate in the financial market with greater precision and assurance. It further provides an opportunity to propel your business forward, helping in speeding up its growth and success. It is not only a tool but an essential choice to optimize future growth and stability. Let ICRA be your partner in navigating the complexities of credit risk and upgrading the path to unlock the potential for exceptional growth and stability. Embrace the power of ICRA’s scorecard and lay the foundation for a brighter financial future. For more info Visit here : portal.icrallc.com

Introducing the ICRA Scorecard Revolutionizing Credit Assessment

Introducing the ICRA Scorecard: Revolutionizing Credit Assessment In the dynamic and constantly evolving realm of finance, quick and accurate decision-making is absolutely essential. At ICRA Rating, we recognize this need and are thrilled to introduce the ICRA Scorecard, a revolutionary tool that simplifies the lending process for various financial institutions, including microfinance institutions (MFIs), Banks, SACCOs, Insurances, and corporations. With the ICRA Scorecard, you can make confident and informed decisions. Count on us to help you succeed in the fast-paced world of finance. In a remarkable display of commitment to the greater good, ICRA Rating offers the ICRA Scorecard free of charge. This levels the playing field for lenders by democratizing access to cutting-edge credit assessment tools. Whether you’re a financial institution in the bustling cities of the United Arab Emirates, the vibrant markets of Tanzania, or the burgeoning economy of Uganda, the ICRA Scorecard is readily available to support your lending decisions. Unveiling the ICRA Scorecard The ICRA Scorecard represents a significant leap forward in credit assessment methodology. It is an in-demand tool, meticulously crafted to expedite lending processes while ensuring precision and reliability. At its core, the scorecard aims to empower lenders with actionable insights into the creditworthiness of potential borrowers. Empowering Decision-Making In a landscape where time is of the essence, the ICRA Scorecard emerges as a beacon of efficiency. By leveraging advanced algorithms and data analytics, it empowers lenders to make informed decisions regarding loanable amounts, interest rates, and loan terms swiftly. This not only enhances operational efficiency but also minimizes the risk associated with lending. The Path to Financial Inclusion One of the key objectives of the ICRA Scorecard is to foster financial inclusion on a global scale. By providing a standardized assessment tool, ICRA Rating aims to facilitate access to credit for individuals and businesses across diverse socio-economic backgrounds. This helps to promote fairness and equality in the financial sector. Join the Revolution The ICRA Scorecard represents more than just a tool; it embodies a paradigm shift in credit assessment. By embracing innovation and inclusivity, ICRA Rating paves the way for a future where access to credit knows no boundaries. Join us in shaping this future – reach out today to unlock the power of the ICRA Scorecard and revolutionize your lending operations. Visit Here – portal.icrallc.com Take the first step towards a better future with ICRA. Contact Our Experts!