Bank Ratings: Overview and Importance to Investors Bank ratings are assessments of a bank’s financial health, stability, and creditworthiness. Bank ratings are expressed in letter grades, such as AAA, AA, A, and so on, with each grade reflecting a different level of risk and stability. Higher ratings indicate a lower risk of default and greater financial stability, while lower ratings suggest higher risk. Let us understand what bank ratings are and how they can be of benefit to us? ICRA Bank ratings are evaluations that are done to get insights into various factors that affect ratings such as financial health, operational efficiency, market position, and other risk management practices of banks and these are conducted by specialized agencies. To get an in-depth understanding of the overall performance and creditworthiness of banks this measure known as bank ratings assists various stakeholders in making well-defined decisions. By ensuring the stability and credibility of the banks, ICRA bank ratings not only promote an elevated economic performance but also ensure the financial goals of the country. Exploring the Critical Role of ICRA Bank Ratings A wide range of challenges are faced by many banks in African countries such as economic inconsistency, lack of regulatory compliance, and political instability. It suggests that simply understanding bank ratings will directly create a better economic landscape, which oversimplifies the complex relationship between bank ratings and economic outcomes. The role of bank ratings is more about providing information and guidance rather than directly creating economic improvements. The identification of strengths and weaknesses of individual banks can be done with the help of ICRA bank ratings that foster promoting a stable financial sphere. ICRA Bank ratings are of utmost importance since investors rely heavily on them to make well-defined decisions regarding their investments. With transparent information on the table, investors get to see the overall performance and financial health of the banks thus mitigating any potential risks. A high-rated bank gets to demonstrate its financial stability further playing an important role in providing services like issuing loans, credit facilities, and trade finance services. For African banks, these bank ratings serve as a benchmark. ICRA bank ratings allow the banks to compare their performance against their competitors in the industry. With an idea of their performance in the market, these African banks get to improve their areas of weakness and elevate their operational performance. Top Expert Tips to Boost Your Bank Rating By ensuring probability and maintaining consistency with strong revenue growth entities can maintain their strong financial health. An adequate cash flow is required to meet obligations and maintenance of liquidity and debt levels. With the establishment of robust governance and ensuring that transparency is maintained while engaging in operations and financial reporting. Diversification of revenue streams allows entities to rely less on a single source of revenue with offerings of different products and services. Achieve Better Bank Ratings with ICRA The providence of transparent and comprehensive insights with ICRA bank rating service helps investors and stakeholders to choose their trustworthy financial partners. This not only facilitates confidence and trust but also assists stakeholders in making well-informed decisions. Furthermore, a more stable and robust financial system is promoted with the ensure of bank’s adherence to regulatory requirements through ICRA bank ratings. With the evolving challenges on the rise and the growth of African countries in the economic sphere, the role of bank ratings is more important than ever. Paving the way for a secure financial landscape in African countries with bank ratings for elevated growth and success. For more info Visit here: www.icrallc.com

Category: Uncategorized

Corporate Ratings By ICRA – Enhancing Transparency and Trust

Corporate Ratings By ICRA – Enhancing Transparency and Trust Corporations must demonstrate credibility and stability for investors, stakeholders, and creditors in the financial landscape to make well-defined decisions. With corporate ratings, you get access to the financial health and risk profile of companies that enables the stakeholders to get an in-depth evaluation further leading to trust and confidence in the corporate realm. By providing reliable and accurate ratings, ICRA spreads out a path for various stakeholders to navigate the intricate realm of finance through these corporate ratings. Let us take a look at how you can benefit from ICRA’s corporate ratings. Understanding the in-depth benefits of corporate ratings Financial Transparency – A comprehensive evaluation of a company’s financial performance is offered to the stakeholders which enables them to have a transparent picture of the company’s financial and risk profile. This helps in achieving a clear understanding regarding the financial position of the company further assisting the stakeholders in making well-defined decisions. Detailed Analysis – Corporate ratings give stakeholders in-depth insights into the financial statements of the company. These detailed assessments include cash flow statements, income statements, and balance sheets to further identify the areas of strengths and weaknesses. Access to Capital – Enhance your company’s credibility in the eye of investors by the demonstration of high ratings only through ICRA corporate ratings. Since high ratings signify low chances of default it enables companies to gain access to funding with favorable terms and low borrowing costs leading to better access to funding. Risk Management and Benchmarking – With the early identification of potential risks the companies have a better chance to implement necessary measures. Corporate ratings also help in identifying risks associated with a company’s operations, its financial practices, and its environment. By benchmarking performance against other competitors in the industry, companies get to locate their position within the market and improve the areas required for an elevated performance. Market Perception – A business can achieve new heights and enhance its growth and success with its strong reputation in the market. With the demonstration of a higher corporate rating, it signals stability and reliability to potential partners that can enhance its perception in the market further fostering new relationships built on credibility and trust. ICRA corporate ratings are not only helpful in navigating the intricate dynamics of global commerce but they also ensure that companies comply with regulatory requirements and adhere to industry standards which benefits in mitigating legal risks and any other penalties. With access to better funding and insights into areas of weakness, companies implement practices and plan strategic moves to elevate their position in the industry further. For more info Visit here: www.icrallc.com

ICRA’s Bank Ratings: Benchmark for Trust and Credibility

ICRA’s Bank Ratings: Benchmark for Trust and Credibility Bank ratings by ICRA assess the creditworthiness of the banks. Bank ratings hold significant importance in the financial arena since stakeholders rely on them to comprehend the stability and reliability of banks. ICRA plays an important role in providing in-depth assessment of entities to gain access to their financial health and overall profile. Bank ratings by ICRA help provide insights regarding the overall performance of the bank such as their asset quality, profitability, and management quality. The bank rating range is a reflection of a bank’s ability to meet its financial commitments and the potential risks involved. These ratings range from high-grade to speculative grade, further labeling various levels of risks in accordance with each grade as a high grade indicates the very low level of credit risk involved, and similarly, a speculative-grade is an indication of higher credit risk. Why do bank ratings matter? These unbiased evaluations hold paramount importance when it comes to stakeholders such as investors, regulators, or customers to make an informed decision. Let’s take a look at the importance of bank ratings and why they matter not just for stakeholders but for banks too. Boosts Confidence and Decision-making: To make well-defined decisions regarding investments bank ratings are crucial since investors rely heavily on it. These ratings help investors in maximizing their returns by diversifying their investment portfolio. A bank that has a high rating makes them an attractive investment choice since they indicate low risk thereby enhancing a bank’s reputation and its stock price. Economic Impact and Market Stability: Banks have a major impact on the economy and with these ratings, it becomes easy to identify banks whose failure could have a significant impact on the financial landscape. A smooth functioning of the financial market is also crucial in the broader economic system which is done when the public places their trust in a strongly rated entity or banking system. Access to Capital and Borrowing Cost: The terms of credit lines and their availability are largely influenced by ratings which can further affect a bank’s liquidity and other operational management. It will be easier to gain access to the capital market at a low cost if the bank is rated high and this is done by negotiating for better loan terms thereby reducing the overall cost of capital. Invest Smart, Invest Safe – With ICRA Bank ratings are not just mere numbers but rather they hold paramount importance because of their benefits in the economic sphere. These ratings are beyond assessment since they have a far-reaching impact on investors, regulators, customers, and the bank themselves. When the public is provided with a transparent picture of an entity’s creditworthiness, it becomes easy for them to make decisions and place their trust in the stability of the financial system with these ratings. Ensure financial stability and unlock financial clarity with ICRA’s trusted bank ratings. With the evolving challenges in the financial sphere, ICRA stands up to its mission with a commitment to provide accurate and transparent ratings. With ICRA’s robust methodology and in-depth insights, stakeholders get to make clear-cut decisions with access to reliable and credible assessments further facilitating economic growth. For more info Visit here: www.icrallc.com

Credit Ratings: Its Impact On Financial Stability and Investment Decisions

Credit Ratings: Its Impact On Financial Stability and Investment Decisions Credit ratings hold a front foot when it comes to the financial sector since they determine the borrower’s financial statements on a broader term. Credit ratings reflect a borrower’s creditworthiness and their likelihood of meeting financial obligations in a given time frame. Credit ratings can have an impact on the overall performance of the financial market since they affect borrowing costs and further influence the market stability. Credit ratings not just impact the overall financial market but also assists investors and lenders in making well-defined decisions by providing them with an assessment of risk associated with a certain investment. At ICRA Credit Rating Agency, we help provide the credible and transparent in-depth evaluation. Credit ratings are determined by various factors such as the financial statements of the borrower’s which includes their income, debt levels, further their economic conditions and borrower’s position within the industry is also taken into consideration when evaluating a credit rating. Showcase your credibility with a higher credit rating and open doors for multiple opportunities by gaining investors confidence and trust. Crucial Role of Credit Ratings in Financial Markets Credit ratings are vital in the financial landscape since investors rely heavily on these ratings while making any investment decision. Not only investors but Governments and public sectors to gauge their ability to borrow money to fund projects and developments and manage public debt. With a higher credit rating, one can have better access to new markets and expand their business by taking it global. A strong credit rating not only attracts investors but it also helps you grow with new opportunities in the market and unbolt confidence with a standard position in the industry. Since credit ratings provide in-depth insights regarding an organization and its performance, further providing an understanding of the strengths and weaknesses of that organization. These insights help an organization to gain a picture of their position in the financial market and improve their areas of weakness inorder to compete against industry peers. A demonstration of transparent credit rating offers a comprehensive picture of the financial performance of an organization and with this it allows investors to make informed decisions regarding their investments. This helps in building trust and security with potential investors by articulating your financial health and risk profile with the transparent presentation of the creditworthiness of your organization. Why Choosing ICRA Credit Ratings is a Smart Move? ICRA is a trusted credit rating agency that has served in many countries across the world by providing accurate and transparent credit ratings for various financial institutions. Navigate the complexities of the financial landscape with utmost trust and confidence with ICRA Credit Ratings. Gain investors confidence and elevate your business growth to new heights by showcasing your company’s creditworthiness. With ICRA Credit Ratings, achieve a competitive advantage in the global financial sector by taking well-defined investment decisions. Gain a positive reputation by maintaining good relations with the investors in the market and improve your overall market perception for future funding. Let ICRA experts with years of experience help you gain an in-depth analysis of your financial profile with their use of rigorous methodology to further help you achieve success and growth. For more info Visit here: www.icrallc.com

Navigating Financial Success with ICRA Scorecard

Navigating Financial Success with ICRA Scorecard At ICRA, we provide a holistic view of an entity’s credit profile by taking into consideration alot of factors with the ICRA Scorecard. ICRA Scorecard is not just an evaluation tool that provides a comprehensive report by assessing credit worthiness of an entity but it also provides an understanding of credit risk associated to help investors make well-defined financial decisions. ICRA Scorecard is a free of cost tool which enables investors to leverage its benefits with evaluation of their financial performance. Various factors such as management quality, market position and industry dynamics are taken into consideration while assessing a company’s credit standard. With ICRA Scorecard boost your confidence and be in the eyes of the investors with demonstration of transparent credit assessments. So whether you are a financial institution in Uganda, Tanzania or UAE let ICRA Scorecard be your ultimate ally in supercharging your credit evaluations. Securing loans or credit has been easier only if you choose to avail your ICRA Scorecard today. Leverage ICRA Scorecard benefits – ICRA Scorecard has a huge influence on the financial market since investors and lenders rely on accurate and reliable credit assessments. ICRA Scorecard offers a holistic view of the creditworthiness of the entity with a detailed insight into the entity’s financial performance and risk profile. Insights such as cash flow, debt levels, and revenue are helpful since they guide investors into making well-defined investment decisions by assessing the overall financial profile of the entity. This clear demonstration of an entity’s financial profile assists in identifying, monitoring, and measuring any potential risks. The use of robust methodology with quantitative and qualitative metrics ensures a standard level of rating and allows easy comparison between entities in the industry. With a high score one can open the door for more investment opportunities get to be in the eye of the investors and gain access to better funding at lower rates. This enables an entity to showcase its credibility and a chance to uplift its reputation in the market with a strong rating. ICRA – Your Partner for Comprehensive Credit Insights ICRA Scorecard is a zero-cost comprehensive tool with thorough evaluation designed in a way to elevate your financial decisions. Investors and lenders get a better understanding with accurate assessments further fostering confidence in them while making any investment decisions. ICRA’s extensive global reach makes ICRA Scorecard an invaluable tool for cross-border financial insights. Get a holistic view and detailed analysis of your financial profile, company performance, and industry position that will assist you in comprehending your financial stability and areas to be improved for future growth and opportunities. With a clear picture of your position in the market, this insight will help you plan your strategic moves for a better performance against the competitors within the industry. With a commitment to providing reliable and accurate insights, ICRA’s global reach with over 110 ratings delivered across 25 countries in diverse industries serves as a testament to its vision. Let ICRA be your partner in navigating complexities with precision and making well-defined decisions to achieve strategic success and growth. For more info Visit here: www.icrallc.com

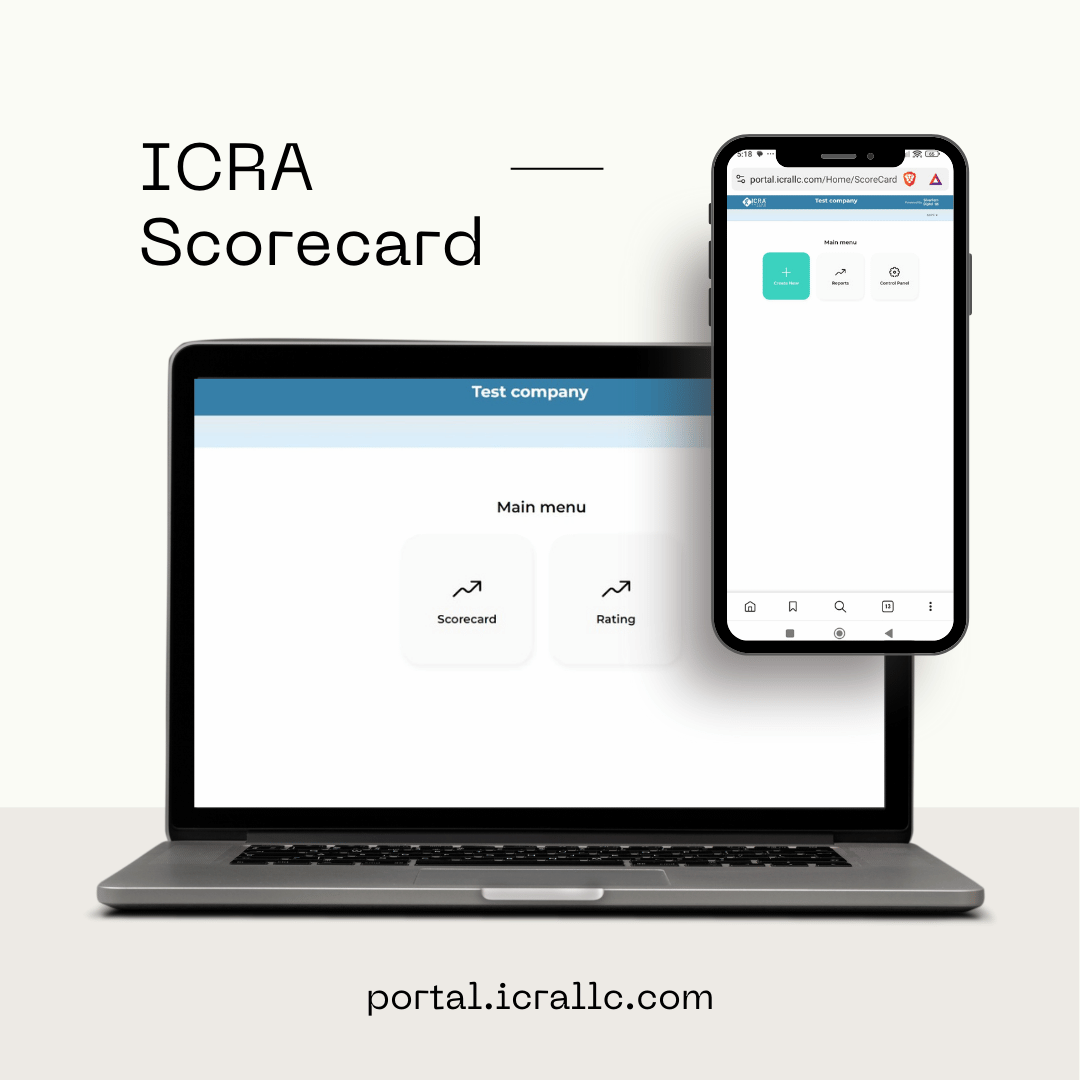

ICRA Scorecard – Understanding Its Role and Importance

ICRA Scorecard – Understanding Its Role and Importance Credit Rating Agencies play an important role when it comes to providing vital credit ratings that offer invaluable insights to investors and lenders. Amongst many services that ICRA Credit Rating Agency offers like ESG Ratings, Issuer Credit Ratings, and Portfolio Ratings, there stands a key tool – ICRA Scorecard. ICRA Scorecard is a Crucial tool that is used to evaluate the creditworthiness of various financial entities. ICRA Scorecard is designed in such a way that it provides us with transparent and objective information regarding credit risk which helps in facilitating well-defined decisions. ICRA Scorecard provides us with an in-depth understanding and assessment of financial health of an entity along with other parameters such as their position in the industry and their management quality. Why is the ICRA scorecard important? ICRA scorecard holds paramount importance and for many reasons. Here’s why.. Enhance Investor Confidence – It is a fact that many investors rely heavily on credit ratings when it comes to making investment. These credit ratings guide them by providing a transparent evaluation of creditworthiness and the potential risk involved. With these credit ratings it becomes easy for investors to navigate through the complexities of the financial realm and make informed decisions regarding their investment. Through ICRA Scorecard their confidence is boosted further facilitating more participation in the financial landscape. Promotion of Market Efficiency – ICRA Scorecard plays an important role when it comes to providing reliable and accurate credit assessments since financial markets depend heavily on availability of such information. ICRA Scorecard has an immense contribution when it comes to market efficiency and with this participants in the global market gets elite access to transparent and reliable credit ratings leading to a more stable financial market with better decision making. Effective Risk Management – Financial stability is crucial for investors with effective risk management. ICRA Scorecard helps mitigate risks by providing detailed information of credit risk involved further assisting investors in identifying, measuring and monitoring risks. This assessment ensures that engagement takes place with parties that are reliable further mitigating any risk of financial contagion. Access to Capital Markets – It becomes necessary for companies to gain funding to operate and for its growth. Investors favor entities that are rated highly which can further reduce the cost of capital for the issuer. This facilitates an entity’s ability to raise funds which can further be invested in expanding their projects and innovation. Leverage ICRA Scorecard for Financial Excellence Invest in the power of well-defined decision-making with ICRA Scorecard. At ICRA Credit Rating Agency we believe in providing credit evaluation that is comprehensive, transparent and accurate. With a motive to enhance investors’ confidence and fostering trust among counterparties, our key tool ICRA Scorecard holds a paramount importance in fostering this trust in the economic market and maintaining financial stability. ICRA Scorecard uses a robust methodology and with its continuous monitoring, it ensures that the information is provided with up-to-date information and accuracy. Reaching out to ICRA can be your next step toward financial growth and confidence. With ICRA you gain access to expert analysis, comprehensive rating services, and in-depth reports that can help you navigate the complexities of credit risk with great ease and confidence. For more info Visit here : www.icrallc.com

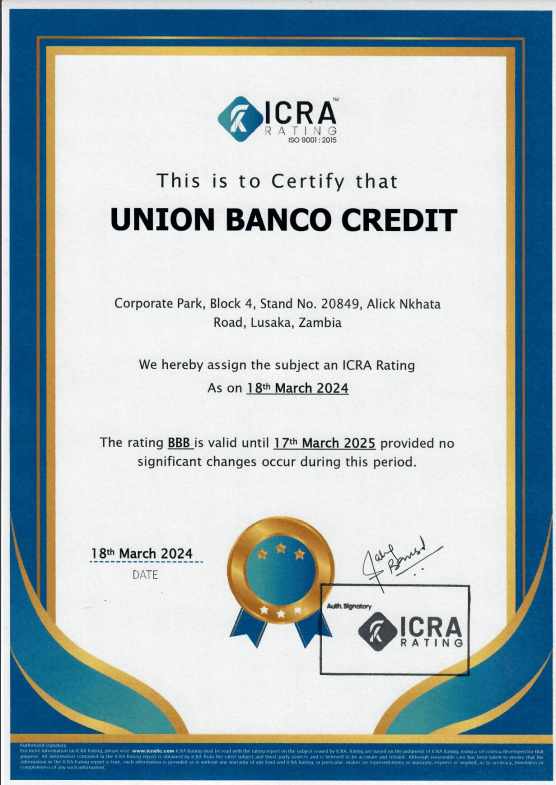

ICRA RATING assign Union Banco Credit Limited national scale long-term issuer

ICRA RATING assign Union Banco Credit Limited national scale long-term issuer rating to ‘BBB’ ICRA RATING assigns Union Banco Credit Limited national scale long-term issuer rating to BBB; Outlook Stable ICRA Ratings (ICRA) has assigned Union Banco Credit Limited national scale long-term issuer rating to BBB and affirmed the long-term stability of the institution in the domestic market. A rating means the entity has a considerable risk level to fulfill its financial commitments. There is a considerable risk of being adversely affected by foreseeable events and moderate credit risk on the institution

ICRA RATING assign Banco Micro Capital Finance Limited national scale long-term issuer rating

ICRA RATING assign Banco Micro Capital Finance Limited national scale long-term issuer rating to ‘A’ ICRA RATING assign Banco Micro Capital Finance Limited national scale long-term issuer rating to A; Outlook Stable ICRA Ratings (ICRA) has assigned Banco Micro Capital Finance Limited a national scale long-term issuer rating of A and affirmed the long-term stability of the institution in the domestic market. A rating means the entity is in a stable and strong position to fulfil its financial commitments. There is a marginal risk of being adversely affected by foreseeable events and low credit risk on the institution.

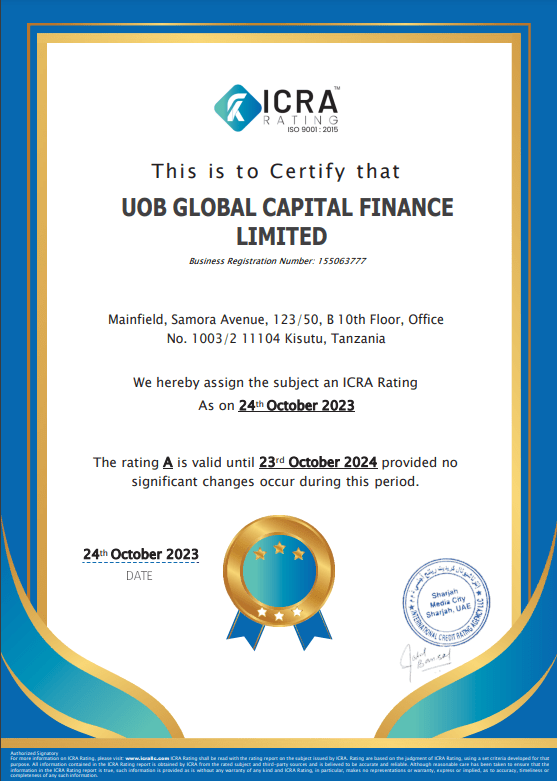

ICRA RATING assigns UOB Global Capital Finance Limited national scale long-term issuer rating to A

ICRA RATING assigns UOB Global Capital Finance Limited national scale long-term issuer rating to ‘A’ ICRA RATING assigns UOB Global Capital Finance Limited national scale long-term issuer rating to A; Outlook Stable ICRA Ratings (ICRA) has assigned UOB Global Capital Finance Limited a national scale long-term issuer rating of A and affirmed the long-term stability of the institution in the domestic market. A rating means the entity is in a stable and strong position to fulfill its financial commitments. There is a marginal risk of being adversely affected by foreseeable events and low credit risk on the institution.

ICRA Credit Ratings – Empowering Issuers with Financial Clarity

ICRA Credit Ratings – Empowering Issuers with Financial Clarity Credit ratings play a fundamental role in the functioning of capital markets along with shaping decisions regarding investments. The multifaceted role of credit ratings ranges from influencing borrowing costs to elevating economic growth and stability. This essential tool helps navigate investors, issuers, and financial institutions through the intricate dynamics of risk and opportunities in the financial sphere. At its core, credit ratings provide an evaluation of an entity’s ability to repay its financial commitment. These ratings are an indication of the likelihood of default further serving as a measure of credit risk. By providing transparent and accurate assessments, these ratings help investors make informed decisions regarding their investments. Complex financial data is translated into simplified ratings that allow the investors and financial institutions to make a comparison of the risk associated with different entities. ICRA Credit Rating Agency is one such agency that serves as a benchmark in providing reliable and accurate ratings. ICRA believes in fostering transparency with its credible insights to help maximize potential and influence investment decisions. Role Of Credit Ratings – The role of the credit ratings cannot be overstated especially when it is of profound significance for issuers. These ratings help corporations, financial institutions to influence their financial strategies, market position, investor confidence and regulatory compliance. Boosting Investor Confidence And Enhancing Market Credibility – Since these ratings are an evaluation of an issuer’s creditworthiness, the indication of these ratings help determine the overall financial health which helps investors in making well-defined decisions. A higher rating opens doors for multiple investment opportunities since a good rating is considered favorable by the investors as they rely heavily on it. The risk associated with investments is comforted by the issuer that is rated high as they are perceived as reliable and stable in financial terms. A favorable rating provides a justification for its ability to meet financial obligations by proving its credibility. Determination Of Cost Of Capital – The overall cost of debt is reduced if the issuer has a higher credit rating. Since the cost of capital is largely determined by the issuer’s credit ratings, a favorable rating has a higher chance of accessing the capital at a reasonable interest rate. Similarly, a lower credit rating can have a significant impact on their borrowing cost. These entities have a higher credit risk associated with them which makes it difficult for them to access the capital market and attract investment opportunities. Investors may generally limit their exposure to lower-rated entities and ultimately they have to face higher- interest rates. Market Perception And Investor Relations – A positive signal is indicated to the market when an entity has a higher credit rating. This helps in maintaining good relations with the investors and a good hold on the market perception of the entity. With a positive reputation, the chance for fostering trust and building confidence is elevated amongst the investors.by reinforcing a strong performance and market position, positive market perception is created for issuers with higher ratings. Meanwhile, a lower credit rating can downgrade its image in the market with a negative perception further leading to a decrease in potential investors and opportunities. Guiding Precision And Trust With ICRA – Credit ratings provided by ICRA play a crucial role in the financial sphere by providing accurate, in-depth, transparent ratings to help shape the financial strategies and decision making. ICRA serves as a barometer of creditworthiness by offering a comprehensive assessment of an entity’s credit risk further guiding investors, lenders, corporations to help influence their financial decisions. The use of methodology and in-depth analysis by ICRA are done to evaluate factors such as performance, operational efficiency, market condition, regulatory compliance. For more info Visit here : www.icrallc.com